Paytm IPO

One 97 Communications, which owns Paytm, was incorporated in India in August 2010 with a $2 million investment. Founded by Mr Vijay Shekhar Sharma and was initially involved in mobile services like astrology, music, messaging and other SMS based applications. Then they started to offer mobile content like news, cricket scores and ringtones in the mobile marketing space.

Paytm was the first to start the digital revolution in India, and over the years, it evolved as India’s leading Payments App. Paytm powers more than 20 million merchants and businesses to accept payments digitally. In addition, they have added other services like Paytm wallet, Paytm mall, online ticket bookings like movies, air travel, and other events. Also, offer all types of bill payments, Paytm gold, Paytm merchant app for businesses, Paytm first games, an online gaming platform, Paytm money for online stockbroking, and investment platforms.

Journey of Paytm

2009– Launch of Paytm

2012– Paytm Gateway

2014– Bus ticketing and Paytm wallet

2015– Bill payments, movie ticketing, QR Codes

2016– Train ticketing, Flight ticketing

2017– Paytm UPI, Insurance Attachment, Paytm Payments Bank, Paytm Gold, FASTag, Events Ticketing

2018– Paypay, Paytm Money, Paytm First Games

2019– BNPL, Merchant Cash Advance

2020– Soundbox, BNPL 2.0, Insurance Broking, All in One QR, All in One Gateway, All in One Android POS, Credit card

2021– Equity Trading, Smart POS, Derivatives/F&O

Company Promoters

Paytm is a professionally managed company and does not have an identifiable promoter. Mr Vijay Shekhar Sharma is the Managing Director and Chief Executive Officer of the company and the Chairman of the Board. He holds 14.97% of the company, which is less than the 20% promoter mandate. It is backed by many marquee investors like Alibaba Group, Ant financial run by Alipay in China, Softbank, SAIF Partners, Berkshire Hathaway and others.

Qualitative Factors

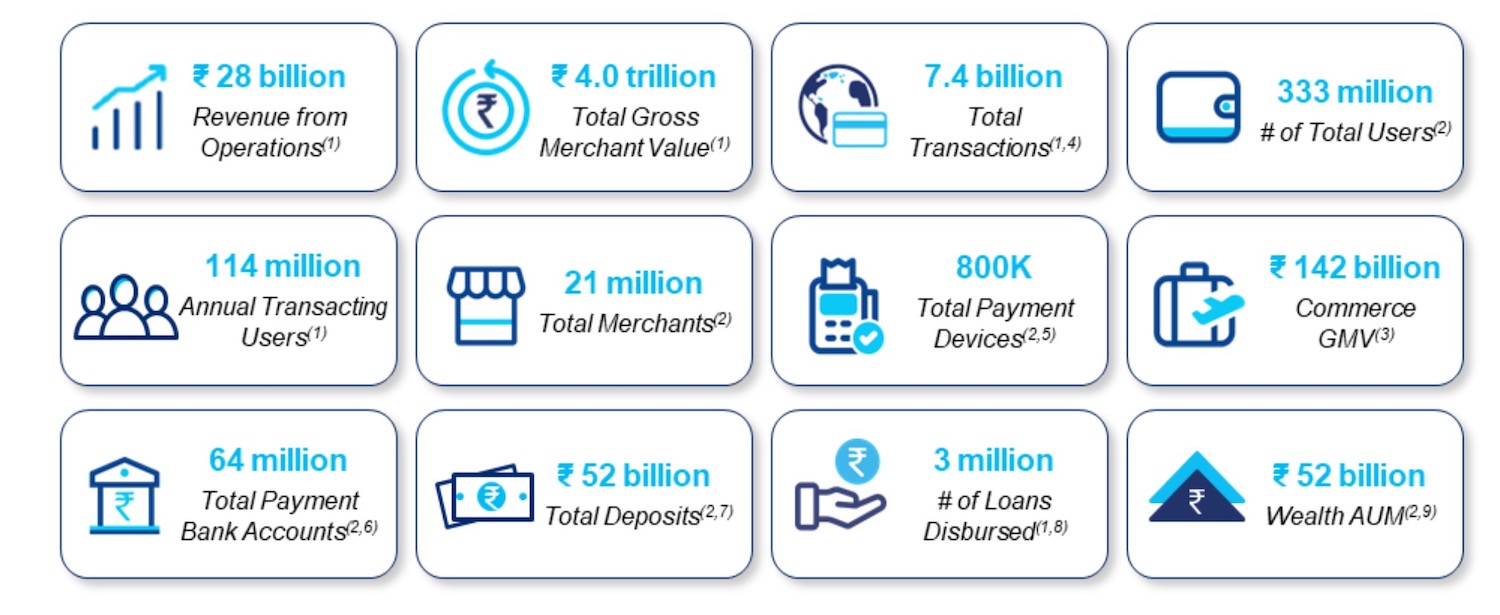

- The significant user base of 333 million and 21 million merchants.

- Trusted brand, scale and reach.

- Have deep insights into Indian consumers and merchants.

- Various products and technology DNA.

- Have excellent leadership and distinctive culture.

Objects of the issue

- Growing and strengthening their Paytm ecosystem, including acquiring and retaining consumers and merchants and providing greater access to technology and financial services.

- Investing in new business initiatives, acquisitions and strategic partnerships.

- To meet general corporate purposes.

Financials of Paytm IPO

| Parameter (₹ in million) | FY21 | FY20 | FY19 |

| Total Revenue | 31,868 | 35,407 | 35,797 |

| Total Expenses | 47,830 | 61,382 | 77,439 |

| PAT | (17,010) | (29,424) | (42,309) |

| Total Assets | 91,513 | 103,031 | 87,668 |

| EPS | (28) | (49) | (75) |

The total revenue saw a drop of 10% YoY, expenses by 22% and loss after tax by 42% YoY. The primary reason for the revenue fall is a decline in commerce and cloud services from Rs 1119 cr in FY20 to Rs 693 cr in FY21. The primary revenue line of payments and financial services grew to Rs 2109 cr in FY21 from Rs 1907 cr in FY20. The advertising costs were reduced, leading to fewer expenses from Rs 3408 cr in FY19 to Rs 532 cr in FY21. The company is debt-free, with no long-term borrowings and has a current ratio of 3.34 that shows a healthy balance sheet.

Paytm IPO Issue Details

| Issue Open | 08 Nov 2021- 10 Nov 2021 |

| Issue Type | Book Built Issue IPO |

| Issue Size | [.] equity shares of ₹ 1 (aggregating up to ₹ 18,300 Crores) |

| Fresh Issue | [.] equity shares of ₹ 1 (aggregating up to ₹ 8,300 Crores) |

| Offer for Sale | [.] equity shares of ₹ 1 (aggregating up to ₹ 10,000 Crores) |

| Face Value | ₹ 1 per equity share |

| Issue Price | ₹ 2080 to ₹ 2150 per equity share |

| Market Lot | 6 shares |

| Min Order Quantity | 6 shares |

| Listing At | BSE, NSE |

| Allotment Date | 15 Nov 2021 |

| Listing Date | 18 Nov 2021 |

Paytm IPO Bid Details

| Sl No. | Category | Subscription Status (No. of times) | ||

| 08 Nov 21 | 09 Nov 21 | 10 Nov 21 | ||

| 1. | QIB | 0.06 | 0.46 | 2.79 |

| 2. | NII | 0.02 | 0.05 | 0.24 |

| 3. | RII | 0.78 | 1.23 | 1.66 |

| Total | 0.18 | 0.48 | 1.89 | |

| Book Running Lead Managers to the Offer |

| 1. ICICI Securities Limited |

| 2. JP Morgan India Private Limited |

| 3. Citigroup Global Markets India Private Limited |

| 4. HDFC Bank Limited |

| Registrar to the Offer |

| Link Intime India Private Limited |

| C-101, 247 Park, L.B.S. Marg, Vikhroli (West) Mumbai 400 083, Maharashtra Tel: +91 022 4918 6200 E-mail: paytm.ipo@linkintime.co.in Investor Grievance E- mail: paytm.ipo@linkintime.co.in Website: www.linkintime.co.in Contact Person: Shanti Gopalkrishnan SEBI Registration No.: INR000004058 |

Registered Office: First Floor, Devika Tower, Nehru Place, New Delhi 110 019, India; Tel: +91 11 2628 0280; Website: www.paytm.com Corporate Office: B-121, Sector 5, Noida, Uttar Pradesh 201 301, India |

Source: One 97 Communications Limited RHP

Also Read:

Great